Acquisition project | Workindia

Product

WorkIndia, a two-sided job marketplace, connects job seekers and employers in the blue and grey collar sectors, and has grown to an ARR of over 10M USD. The platform caters to individuals with limited academic qualifications seeking jobs in fields like delivery driving, tele-calling, and cooking, offering potential earnings from 10-50k INR. WorkIndia provides various job types, including full-time, part-time, and work-from-home positions.

Employers, primarily small and medium-sized businesses (SMBs), subscribe to premium plans costing between 5,000 to 10,000 INR annually to post job vacancies on the WorkIndia website and Android app. Job seekers use the WorkIndia app to apply for these positions, leveraging the skills and qualifications detailed in their profiles. WorkIndia’s relevance algorithm curates valuable job recommendations for candidates based on criteria such as skills, qualifications, salary expectations, location, and time to hire.

DAU - 500k & MAU - 3 Million

How Workindia makes money

- Subscription-Based Model: WorkIndia offers large corporations & SMBs access to a pool of relevant & qualified candidates through a subscription-based model, generating recurring revenue for the company.

- Advertising: WorkIndia also generates revenue by offering targeted advertising on its platform, relevant to both job seekers and employers.

For candidate the Job Search app is totally free.

Reviews on App Store

Sample of reviews - both positive and negative.

Workindia is a amazing app for finding Jobs as you can directly can connect to the HR. There are filters to choose from which help to narrow your search which is a great feature in the app. I would highly recommend this app for those who looking for a job whether he is a fresher or Experienced.

I give it just 1 star because selection of location is difficult Everytime we need to change the location Also not only select a City but also area where you wanted job City change is not enough you need to change area also again and again

Review Summary

- Positive - Relevant jobs, no fee charged, directly call to HR

- Negative - no jobs found in my location, profile update issue

Ideal Customer Profile

Use cases for Workindia Job Search App-

- Experienced restaurant chef looking for a better paying job in nearby locality

- 10th or 12th pass fresher looking for part-time/WFH jobs to support their education and family

- Fresh college accounts graduate looking for their first job in Account related field

- Graduate people in tier 2,3 cities looking for job in nearby metro cities

- House cook looking for more part time opportunity

- Warehouse worker with bike driving skill looking to get employment in newly emerged e-commerce delivery sector jobs

ICP 1: The Young Gun

Demographics

- Name: Aditya Patel

- Age: 21-26

- Gender: All

- Income: No income to ₹20,000/month

- Relationship Status: Single/Recently Married

- Education: 12th pass to Recent Graduate

- Employment Status: Fresher/Freshly Employed (0-2 years experience)

- Location: Tier 1 cities (e.g., Mumbai, Delhi, Bangalore)

Psychographics

- Ambitious and eager to start their career

- Tech-savvy with high digital adoption

- Values financial independence and career growth

- Seeks validation through professional success

- Open to diverse job opportunities and experiences

Goals and Motivations

- Primary: Secure a good-paying job in a reputable company

- Secondary:

- Gain practical work experience

- Build a professional network

- Achieve financial independence

Pain Points

- Lack of experience makes job search challenging

- Vulnerable to job placement frauds

- Uncertainty about suitable job categories

- Limited professional network for referrals

Behavior Patterns

- Spends 3-4 hours daily on social media (Facebook, Instagram, YouTube)

- Uses WhatsApp as primary communication tool

- Consumes content primarily through YouTube and JioCinema

- Checks job portals and company websites multiple times a week

Decision Factors for Job Applications

- Company reputation

- Salary and benefits

- Job role and growth potential

- Work culture and environment

- Ease of application process

Preferred Job Types

- Full-time roles

- Part-time opportunities

- Work-from-home options

WorkIndia Value Proposition

- Direct contact with recruiters

- Highly relevant job recommendations

- Multiple opportunities across sectors

- Easy access and user-friendly interface

- 100% free service without fraud risks

Acquisition Channels

- Social media advertising (Instagram, Facebook)

- YouTube pre-roll ads

- Google Search (keywords: "entry-level jobs", "fresher jobs in [city]")

- Campus placement partnerships

ICP 2: The Experienced Professional

Demographics

- Name: Priya Sharma

- Age: 26-40

- Gender: All

- Income: ₹15,000 - ₹40,000/month

- Relationship Status: Married, Some Separated

- Education: 10th pass to Post-Graduates

- Employment Status: Employed, 2+ years of experience

- Location: Tier 1 and 2 cities

Psychographics

- Career-oriented with a focus on stability and growth

- Moderately tech-savvy

- Values work-life balance

- Risk-averse but open to calculated career moves

- Seeks recognition and increased responsibilities

Goals and Motivations

- Primary: Increase earning potential through a stable, higher-paying job

- Secondary:

- Transition to a new role or industry

- Secure part-time opportunities for additional income

- Achieve better work-life balance

Pain Points

- Stagnant career growth in current role

- Limited opportunities through existing network

- Difficulty in transitioning to new roles or industries

- Time constraints for job searching due to current employment

Behavior Patterns

- Checks job portals weekly, typically on weekends

- Active on professional networking sites (e.g., LinkedIn)

- Consumes industry-related content on YouTube and professional blogs

- Relies on WhatsApp and Facebook for personal networking

Decision Factors for Job Change

- Significant salary increment (20%+ expected)

- Career growth opportunities

- Job security and company stability

- Work culture and benefits (e.g., health insurance, retirement plans)

- Commute time or remote work options

Preferred Job Types

- Full-time roles with growth potential

- Part-time opportunities for additional income

- Remote or hybrid work options

WorkIndia Value Proposition

- Access to high-paying jobs from reputed employers

- Highly relevant job recommendations based on experience

- Direct contact with recruiters, bypassing lengthy application processes

- 100% free service without hidden charges or fraud risks

Acquisition Channels

- Targeted Paid ads

- Google Search (keywords: "career transition", "high-paying jobs in [industry]")

- Professional development webinars and online events

- Referral programs through existing users

ICP 3: The College Hustler

Demographics

- Name: Riya Gupta

- Age: 16-21

- Gender: All

- Income: No income to minimal pocket money

- Relationship Status: Single

- Education: 10th pass to 12th pass, Current college students

- Employment Status: Fresher, seeking first job experience

- Location: Tier 1 cities (e.g., Mumbai, Delhi, Bangalore)

Psychographics

- Energetic and eager to gain work experience

- Highly tech-savvy and social media-oriented

- Values independence and personal growth

- Seeks to balance studies with practical work experience

- Curious about various industries and roles

Goals and Motivations

- Primary: Secure part-time or work-from-home opportunities

- Secondary:

- Earn pocket money or contribute to education expenses

- Gain practical work experience to enhance resume

- Explore potential career paths

- Develop time management and professional skills

Pain Points

- Lack of work experience makes job search challenging

- Vulnerability to job placement frauds targeting students

- Limited knowledge about job market and opportunities

- Difficulty in finding flexible jobs that accommodate study schedules

- Low-paying job offers that don't seem worth the effort

Behavior Patterns

- Spends 4-5 hours daily on social media (Instagram, YouTube, WhatsApp)

- Consumes content primarily through YouTube and JioCinema

- Frequently discusses job opportunities with peers

- Actively seeks information about internships and part-time work on college notice boards and online forums

Decision Factors for Job Applications

- Flexibility to balance with studies

- Opportunity to learn new skills

- Company reputation and work environment

- Ease of application and onboarding process

- Potential for future full-time opportunities

Preferred Job Types

- Part-time roles

- Work-from-home opportunities

- Internships

- Gig economy jobs (e.g., content creation, tutoring)

WorkIndia Value Proposition

- Direct contact with recruiters hiring for part-time and WFH jobs

- 100% free service without fraud risks

- Easy-to-use platform tailored for young job seekers

- Variety of flexible job options suitable for students

Acquisition Channels

- Instagram and YouTube ads

- Campus ambassadors and college partnerships

- Student-focused job fairs (virtual and physical)

- Peer referral programs

ICP 4: The Rural Aspirant

Demographics

- Name: Rajesh Kumar

- Age: 21-26

- Gender: All

- Income: ₹10,000 - ₹15,000/month

- Relationship Status: Single/Married

- Education: 12th pass to Graduate

- Employment Status: Fresher/Freshly Employed (0-2 years experience)

- Location: Tier 2 and 3 cities, Rural areas

Psychographics

- Ambitious with a strong desire for upward mobility

- Willing to relocate for better opportunities

- Values financial stability and ability to support family

- Curious about urban job markets and lifestyles

- Balances traditional values with modern aspirations

Goals and Motivations

- Primary: Secure higher-paying jobs in nearby cities to increase earnings

- Secondary:

- Gain exposure to urban work environments

- Develop new skills relevant to growing industries

- Achieve financial independence and support family

- Build a career path with long-term growth potential

Pain Points

- Limited job opportunities in current location

- Lack of information about jobs available in nearby towns/cities

- Difficulty in connecting with employers in urban areas

- Vulnerability to fraudulent placement agencies charging fees

- Concerns about relocation costs and urban living expenses

Behavior Patterns

- Active on social media, especially Facebook and WhatsApp

- Consumes content through YouTube and JioCinema

- Relies heavily on word-of-mouth and local networks for job information

Decision Factors for Job Applications

- Salary and benefits package

- Proximity to home town or ease of commute

- Job security and company stability

- Opportunities for skill development

- Assistance with relocation (if required)

Preferred Job Types

- Full-time roles in nearby cities

- Jobs with accommodation provided

- Roles with clear career progression paths

WorkIndia Value Proposition

- Direct contact with recruiters in nearby metro areas

- Access to high-paying job opportunities beyond local markets

- 100% free service without fraud risks

- Comprehensive job listings from multiple cities and towns

Acquisition Channels

- Targeted Facebook ads in regional languages

- Partnerships with local educational institutions and training centers

- SMS and WhatsApp marketing campaigns

- Radio advertisements in local languages

TAM, SAM, SOM Calculations

- Total Population - 1.4 Billion

- Workable Population (Age: 15-59) - 847 Million

- Male - 443.5 M; Female - 411.5 M

*Numbers are in million

Tier wise working population

TAM | Male | Female | Total |

Tier 1 | 30 | 11 | 42 |

Tier 2 | 20 | 8 | 28 |

Rest of India | 273 | 124 | 397 |

Total | 324 | 143 | 467 |

Sector Wise cut

Distribution of Workforce | Tier 1 | Tier 2 | ROI |

Blue Collar | 30% | 40% | 60% |

Grey Collar | 30% | 35% | 25% |

White Collar | 40% | 25% | 15% |

Effective TAM split by Tier & Sector.

TAM Tier Wise | Male | Female | Total |

Tier 1 | |||

Blue Collar | 9 | 3 | 13 |

Grey Collar | 9 | 3 | 13 |

White Collar | 12 | 5 | 17 |

Total | 30 | 11 | 42 |

Tier 2 | |||

Blue Collar | 8 | 3 | 11 |

Grey Collar | 7 | 3 | 10 |

White Collar | 5 | 2 | 7 |

Total | 20 | 8 | 28 |

ROI | |||

Blue Collar | 164 | 75 | 238 |

Grey Collar | 68 | 31 | 99 |

White Collar | 41 | 19 | 60 |

Total | 273 | 124 | 397 |

SAM % | |

Blue Collar | 80% |

Grey Collar | 70% |

White Collar | 90% |

SAM: This is the segment of the TAM targeted by your products and services which is within your geographical reach

SAM Tier Wise | Male | Female | Total |

Tier 1 | |||

Blue Collar | 7 | 3 | 10 |

Grey Collar | 6 | 2 | 9 |

White Collar | 11 | 4 | 15 |

Total | 25 | 9 | 34 |

Tier 2 | |||

Blue Collar | 6 | 2 | 9 |

Grey Collar | 5 | 2 | 7 |

White Collar | 5 | 2 | 6 |

Total | 16 | 6 | 22 |

ROI | |||

Blue Collar | 131 | 60 | 191 |

Grey Collar | 48 | 22 | 70 |

White Collar | 37 | 17 | 54 |

Total | 216 | 98 | 314 |

Grand Total | 256 | 113 | 370 |

SOM % | |

Blue Collar | 10% |

Grey Collar | 25% |

White Collar | 20% |

SOM: This is the portion of SAM that you can realistically capture, considering competition and other constraints.

SOM Tier Wise | Male | Female | Total |

Tier 1 | |||

Blue Collar | 1 | 0 | 1 |

Grey Collar | 2 | 1 | 2 |

White Collar | 2 | 1 | 3 |

Total | 4 | 2 | 6 |

Tier 2 | |||

Blue Collar | 1 | 0 | 1 |

Grey Collar | 1 | 0 | 2 |

White Collar | 1 | 0 | 1 |

Total | 3 | 1 | 4 |

ROI | |||

Blue Collar | 13 | 6 | 19 |

Grey Collar | 12 | 5 | 17 |

White Collar | 7 | 3 | 11 |

Total | 32 | 15 | 47 |

Grand Total | 40 | 18 | 57 Million SOM |

Workindia has ~57 Million SOM across India.

ICP Prioritisation

Scoring (1-5 scale, 5 being the best)

Criteria Young Guns Experienced Pros College Students Rural Hustlers Market Size (SOM) 4 3 3 5 Acquisition Cost 3 4 2 4 Lifetime Value 4 5 3 3 Growth Potential 4 3 4 5 Platform Fit 5 4 3 3 Total Score 20 19 15 20

Quick Reasoning

- Young Guns: Best current fit, high LTV

- Experienced Pros: Highest LTV, but smaller market

- College Students: Lowest cost, but low LTV and platform fit

- Rural Hustlers: Largest market and growth potential, needs platform adaptation

Recommendation

- Short-term: Focus on Young Guns and Experienced Pros

- Mid-term: Expand to Rural Hustlers

- Long-term: Develop offerings for College Students

This approach balances immediate revenue with future growth opportunities.

Growth Objective

Workindia aims to double its DAU user base from 500k to 1000k, primarily focusing on ICP 1 and ICP 4. This growth will build the supply for onboarding employers across various job categories and successfully fulfils their hiring needs.

Acquisition Channels

Current Scenario: Workindia spends approximately 62 lakhs monthly, resulting in around 10 lakhs monthly downloads, with 46% new users and 56% returning users.

Channel vs Parameters | Organic (SEO/App Store) | Paid Ads | Referral Engine | Affiliate |

Flexibility | High | High | High | Medium |

Effort | Medium | Medium | Low | Low |

Speed | High | High | Medium | Medium |

Scale | High | High | Low | Medium |

CAC | Low | High | Low | High |

Top 2 acquisition levers -

- Organic - 334k

- Playstore - 260k

- SEO through workindia website - 74k

- Paid

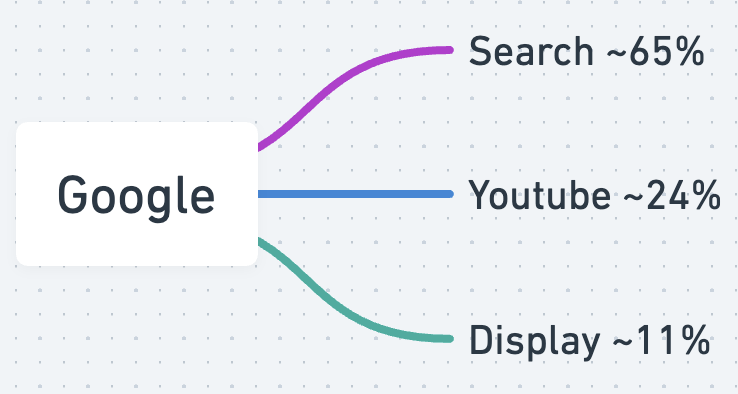

- Google - 245k (Spend - 29 lakhs/month)

- Meta - 140k (Spend - 20 lakhs/month)

Organic Channel

ASO Strategy for Workindia

Significant portion (26%) of monthly downloads come through the app store. ASO will enhance ranking for relevant keyword searches by ICP, which can be categorized into:

Apart from this, following metrics needs to be optimized -

- App Store Ratings

- App Store Reviews

- App Store Presentation

This will further boost the ranking in related category apps and trending section.

Experiment 1: Keyword Optimization in App Store Creatives

Objective: Enhance app store visibility and ranking for "work from home" and "part-time jobs" keywords to increase organic installs.

Insight Integration: Effective keyword optimization involves more than just inserting keywords—it's about aligning user intent with app benefits:

- Strategic Keyword Placement:

- Approach: Strategically incorporate variations of "work from home" and "part-time jobs" into app store title, description, and promotional text.

- Impact: Improve app's relevance for these high-demand search queries, potentially boosting visibility and organic traffic.

- Continuous Monitoring and Optimization:

- Metrics: Track keyword rankings, app store impressions, CTR, and conversion rates.

- Iterative Approach: Regularly update keywords based on performance data to maintain or improve rankings and maximize acquisition opportunities.

- Controlled Experimentation:

- Methodology: Utilize A/B testing to compare current creatives (control) against versions optimized with targeted keywords.

- Outcome Focus: Evaluate changes in app store performance metrics to validate the impact of keyword optimization on user acquisition.

Experiment 2: Trust-Building Testimonial Content in App Store Creatives

Objective: Increase user trust and engagement through testimonial content highlighting key trust elements.

Insight Integration: Testimonials can enhance trust and credibility, crucial for driving user acquisition and retention:

- Compelling Trust Signals:

- Content Strategy: Feature testimonials emphasizing benefits like "No consultation charges" and "Directly Contact HR" prominently in app store creatives.

- Impact: Address user concerns directly, building trust and improving perceived value of the app.

- A/B Testing Approach:

- Execution: Test different formats of testimonials (e.g., quotes, video snippets) to identify which resonate best with the target audience.

- Performance Evaluation: Measure engagement metrics (reviews), CTR, and conversion rates to determine the effectiveness of trust-building content.

- Iterative Refinement:

- Continuous Improvement: Use performance insights to refine testimonial content regularly.

- Feedback Utilization: Incorporate user feedback to optimize messaging and visuals, ensuring testimonials effectively communicate the app's benefits and credibility.

Workindia Website SEO Strategy

Workindia gets 74k monthly downloads through search traffic on website. They can really improve their SEO strategy to get ranked top for relevant keywords. Search keywords can be classified as:

Keywords like "Work from home jobs", "Part time jobs" are captured at top rank by Naukri, Olx.

Objective: Improve organic search rankings and capture targeted keyword traffic.

Experiment 1: Category-Specific URL Structure

- Strategy: Create category-specific URLs for job listings, e.g., "/work-from-home-jobs" and "/government-jobs".

- Benefits: Enhance relevance and ranking for high-volume keywords like "Work from home jobs" and "Government jobs".

- Implementation: Ensure category names are included in URL structures to optimize for search engines.

Experiment 2: Backlink Strategy

- Approach: Build backlinks from relevant websites such as Quora pages on job-related topics and resume builder websites.

- Purpose: Increase domain authority and capture traffic for targeted keywords.

- Execution: Focus on acquiring backlinks with anchor texts related to key search terms:

- "Workindia"

- "Get job in 2 days"

- "Get delivery jobs"

- "Work from home jobs"

- "Accountant jobs"

- "Job in Mumbai"

- "Skills for telecalling job"

- "Earn 20k monthly"

Measurement and Optimization:

- Monitor keyword rankings, organic traffic, and backlink quality regularly.

- Adjust SEO tactics based on performance data to maximize visibility and traffic acquisition.

By focusing on structured URL optimization and strategic backlink building, Workindia can enhance its SEO effectiveness, improve search engine rankings, and attract more organic traffic from targeted job-related keywords.

Paid Advertisements - Google & Meta

WorkIndia LTV/CAC Analysis for Paid Ads (Candidate-Focused)

Customer Acquisition Cost (CAC)

Google Ads

- Monthly Spend: 2.9M INR

- Monthly Candidate Downloads: 245,000

- CAC = 2,900,000 / 245,000 = 11.84 INR per candidate download

Meta Ads

- Monthly Spend: 2M INR

- Monthly Candidate Downloads: 140,000

- CAC = 2,000,000 / 140,000 = 14.29 INR per candidate download

Weighted Average CAC

Total Spend: 4.9M INR Total Candidate Downloads: 385,000 Weighted Avg CAC = 4,900,000 / 385,000 = 12.73 INR per candidate download

Customer Lifetime Value (LTV)

Given:

- WorkIndia doesn't monetize candidates directly

- Employers pay 5,000 to 10,000 INR annually for premium plans

- Each employer account allows 2-4 job posts

- Each job post receives about 50 leads

Assumptions:

- Average premium per employer account: 7,500 INR/year (midpoint of 5k-10k range)

- Average job posts per account: 3 (midpoint of 2-4 range)

- Total leads per employer account per year: 3 * 50 = 150 leads

LTV Calculation:

- Value per lead = 7,500 INR / 150 leads = 50 INR per lead

- Assuming each candidate download results in one lead (best-case scenario)

- LTV per candidate download = 50 INR

LTV/CAC Ratio

LTV/CAC = 50 / 12.73 = 3.93

Google - Currently Workindia is getting ~245k monthly downloads after spending 29 lakhs, with CAC around ~12 INR per download. Split of downloads:

- What's working well -

- Campaigns can be targeted at city wise level - 80% traffic currently coming from top 10 cities

- Can be optimised on core actions of user like - calling HR, applying for job after download

- Challenges -

- Scaling campaign takes time, as the algorithm takes time build learnings

- Organic traffic cannibalisation occur sometimes

Meta (Facebook & Instagram) - Currenlty at 140k downloads after spending 20 lakhs per month, with CAC ~14.3 INR per download.

- What's working well -

- Reels or short form trending content is working well

- Scaling campaign is easy

- Challenges -

- Campaign targeting at city level is not working well, only 50% of the spend is going on top 10 cities (target is 80%). Also difficult to optimise on any core candidate actions

- During shopping festival like Flipkart's BBD, CAC shoots up, which is a risk.

WorkIndia Advertising Experiments

Experiment 1: Hyper-Localized Job Opportunity Ads

Reasoning

Given that Google Ads allow for city-wise targeting and are performing well in top 10 cities, we can leverage this strength while addressing Meta's weakness in city-level targeting. This experiment aims to improve performance in Tier 2/3/4 cities and increase the percentage of spend going to top cities on Meta.

Experiment Design

- Create city-specific ad sets on both Google and Meta platforms.

- Use local language and highlight specific job opportunities available in each city.

- Include messaging like "High paying job available in [City Name]" and "Get a job in [City Name] within a week".

- A/B test these ads against generic ads on both platforms.

Metrics to Track

- Click-Through Rate (CTR) by city

- Conversion Rate (CR) from click to app download by city

- Cost Per Install (CPI) by city

- Percentage of spend going to top 20 cities (aim to increase from 50% to 70% on Meta)

- 7-day retention rate of users acquired through these ads

- Number of job applications per user within first week

Experiment 2: Trust-Building Short-Form Video Ads

Reasoning

Meta's strength lies in short-form content, especially Reels. We can leverage this to address the trust issues and provide job-specific guidance, potentially improving the quality of applications and user engagement.

Experiment Design

- Create a series of 15-30 second video testimonials and job guides.

- Include messages like "No consultation fee/100% free" and "Directly Contact HR".

- Create job-specific content, e.g., "If you can speak English, earn 30k by applying to these jobs".

- A/B test these video ads against static image ads on Meta.

- Adapt the best performing concepts into Google App campaigns.

Metrics to Track

- View-Through Rate (VTR) for video ads

- Engagement Rate (likes, comments, shares)

- Click-Through Rate (CTR) to app store

- Conversion Rate (CR) from click to app download

- Cost Per Install (CPI)

- Average Time Spent in App for users acquired through these ads

- Number of "Direct HR Contacts" initiated per user

- Application completion rate for job categories mentioned in ads

Addressing the pain points of ICP segments 'Young Guns' and 'Rural Hustlers'—such as trust and awareness issues, and educating them on various sectors and high-income opportunities—will allow WorkIndia to significantly optimise its acquisition strategy across different channels.

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.